It is the amount received from stockholders over and above the par value of common or preferred shares. In case of cumulative preferred stock, dividends to common stock holders can’t be paid until preferred dividends for the current and prior periods are paid. Preferred stock is a class of a company’s shares which has a ‘preferred’ claim over the company’s profits and net assets. They are similar to debt instruments in that they normally have a fixed pay off which must be paid before any dividends can be paid to the common stock holders. They are similar to equity instruments in that in an event of a company’s liquidation, they share in the proceeds only after all the debts have been paid off. If the dividend percentage on the preferred stock is close to the rate demanded by the financial markets, the preferred stock will sell at a price that is close to its par value.

Accounting Ratios

At the time of conversion, Roberts common stock was trading at $28 per share. The convertible preferred stock was initially issued to stockholders at $65 per share. Convertible preferred stock is a corporate issued preferred stock with a conversion covenant attached to it. The number of common shares to be issued to the investor upon conversion are usually mentioned in the preferred stock agreement; for example, 2 common shares for each share of preferred stock owned. The company may sometimes issue the convertible preferred stock in order to raise funds for its business operations. The conversion ratio of the convertible preferred stock is usually stated in the convertible preferred stock contract.

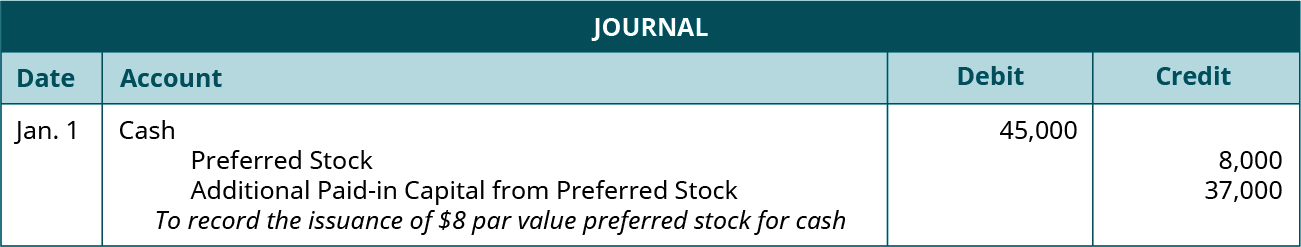

Journal entry for issuance of preferred stock

On the other side, all bonds, including convertible ones, are essentially classified as liability item. Suppose the shares in Example 1 above are entitled to participate to the extent of 10%. If the company’s profit for the 10th year of issue is $1,000,000 before payment of preferred stock dividend, calculate the total preferred stock dividends for the 10th year. The company’s common stock amounts to $10,000,000 and they will get total dividends of $1,000,000 million for the year. In observing the preceding entry, it is imperative to note that the declaration on July 1 establishes a liability to the shareholders that is legally enforceable. Therefore, a liability is recorded on the books at the time of declaration.

- This reclassification can affect the company’s earnings per share (EPS) calculations, making it essential to account for these dividends accurately.

- Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100.

- This classification impacts the company’s debt-to-equity ratio, a key metric for assessing financial health.

- Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

- As you saw in the video, stock can be issued for cash or for other assets.

Preferred Stock Equity

In other words, preferred stockholders receive their dividends before the common stockholders receive theirs. If the corporation does not declare and pay the dividends to preferred stock, there cannot be a dividend on the common stock. In return for these preferences, the preferred stockholders usually give up the right to share in the corporation’s earnings that are in excess of their stated dividends.

Preferred shares are given specific rights that come before those of common stockholders. A set payment amount is often required before common stockholders receive any dividend. Subsequently, capital stock shares can be bought back from investors for a number of reasons. In acquiring these shares, money flows out of the company so the account is reported as a negative balance within stockholders’ equity.

Preferred Stock Dividends

The issuance of preferred stock can significantly impact EPS calculations, primarily due to the fixed dividend payments that must be deducted from net income before calculating EPS for common shareholders. This deduction reduces the net income available to common shareholders, thereby lowering the EPS. The effect is more pronounced for companies with like-kind exchange substantial preferred stock issuances, as the fixed dividends can represent a significant portion of net income. Preferred stock represents a unique class of equity that combines elements of both common stock and debt. It offers investors certain privileges, such as fixed dividends and priority over common shareholders in the event of liquidation.

This reclassification can affect the company’s earnings per share (EPS) calculations, making it essential to account for these dividends accurately. The interplay between dividends and conversion features requires careful attention to detail to ensure that all financial metrics are correctly reported. In above journal entry, the debit to retained earnings account indicates that David Enterprise has offered an additional return to the holders of its convertible preferred stock. The intention of this additional return may be simply to facilitate the conversion.

The holders of these preferred shares must receive the $9 per share dividend each year before the common stockholders can receive a penny in dividends. But the preferred shareholders will get no more than the $9 dividend, even if the corporation’s net income increases a hundredfold. Dividend accounting for preferred stock involves several nuanced considerations that ensure accurate financial reporting and compliance with accounting standards. The process begins with the declaration of dividends by the company’s board of directors.

For example, suppose a business issues 1,000 7% preferred equity stock with a par value of 100 at a premium issue price of 105. The person who purchases the common stock of a corporation becomes an owner of the corporation and is known as common stockholder. Like other convertible securities, convertible preferred stock can be a helpful tool for small and newly formed businesses to make their initial fund raising efforts successful. It can potentially attract those investors who might otherwise not be enticed to put their investment in the company. Some preferred stock issues may not carry forward any interest short-paid or not paid, they are called non-cumulative preferred stock. Except for possible legal distinctions, treasury stock is the equivalent of unissued stock.

In theory, original purchasers of stock are contingently liable to the company for the difference between the issue price and par value if the stock is issued at less than par. However, as a practical matter, par values on common stock are set well below the issue price, negating any practical effect of this latent provision. A comparative review of the preceding tables reveals a broad range of potential attributes.

Cart is empty

Cart is empty

دیدگاه خود را بنویسید