By leveraging useful and insightful formulas such as a company’s Book Value Per Share, investors can determine a company’s value relative to its current market price. A common way of increasing BVPS is for companies to buy back common stocks from shareholders. accounting software This reduces the stock’s outstanding shares and decreases the amount by which the total stockholders’ equity is divided. For example, in the above example, Company X could repurchase 500,000 shares to reduce its outstanding shares from 3,000,000 to 2,500,000.

Everything You Need To Master Financial Modeling

Since a company’s book value represents net worth, comparing book value to the market value of the shares can serve as an effective valuation technique when trying to decide whether shares are fairly priced. Despite the increase in share price (and market capitalization), the book value of equity per share (BVPS) remained unchanged in Year 1 and 2. We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding.

The Formula for Book Value Per Common Share Is:

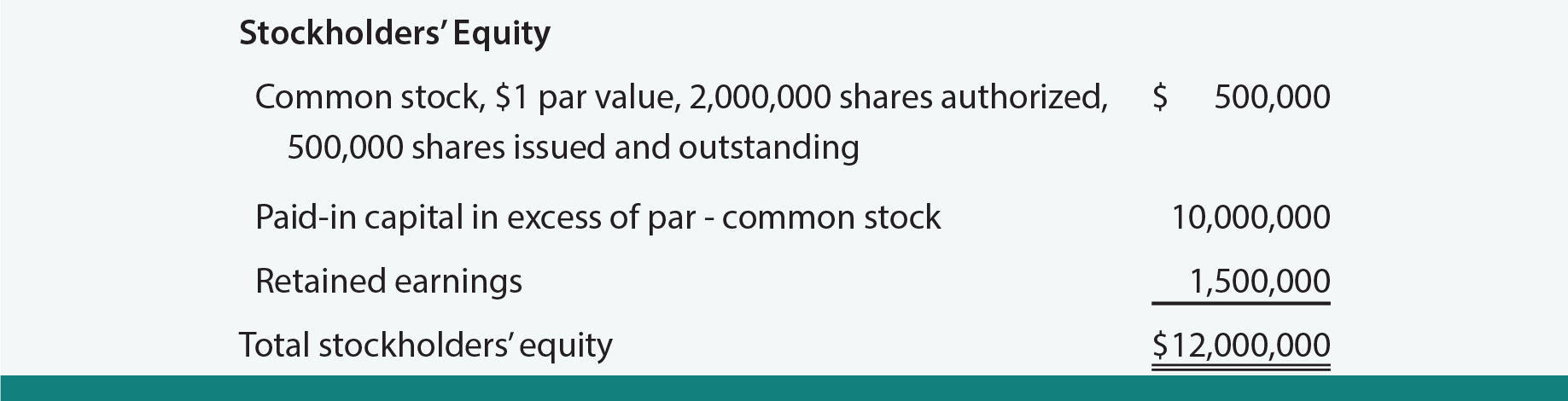

Book Value Per Share solely includes common stockholders’ equity and does not include preferred stockholders’ equity. This is because preferred stockholders are ranked differently than common stockholders in the event the company is liquidated. The book value of common equity in the numerator reflects the original proceeds a company receives from issuing common equity, increased by earnings or decreased by losses, and decreased by paid dividends. A company’s stock buybacks decrease the book value and total common share count. Stock repurchases occur at current stock prices, which can result in a significant reduction in a company’s book value per common share. To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares.

What Does a Price-to-Book (P/B) Ratio of 1.0 Mean?

The stock price will also rise in the market if a company’s share price goes below its book value per share, giving rise to an opportunity for making risk-free profits. But if the stock holds negative book value, then it represents a company’s liabilities are more than its assets, resulting in balance sheet insolvency. Commonly used by stock investors and analysts, the Book Value Per Share (BVPS) metric looks at a company’s stock price to determine whether it’s undervalued compared to the stock’s current market price. Book value is the value of a company’s total assets minus its total liabilities. It may not include intangible assets such as patents, intellectual property, brand value, and goodwill. It also may not fully account for workers’ skills, human capital, and future profits and growth.

This would depend on how P/B ratios compare against other similarly sized companies in the same sector. The P/B ratio has been favored by value investors for decades and is widely used by market analysts. Traditionally, any value under 1.0 is considered desirable for value investors, indicating an undervalued stock may have been identified. However, some value investors may often consider stocks with a less stringent P/B value of less than 3.0 as their benchmark. The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

- This differs from the book value for investors because it is only used internally for managerial accounting purposes.

- Thus, the ratio isn’t forward-looking and doesn’t predict or indicate future cash flows.

- You need to find the company’s balance sheet to obtain total assets, total liabilities, and outstanding shares.

- Book value per share is the portion of a company’s equity that’s attributed to each share of common stock if the company gets liquidated.

Book Value per Share (BVPS) is the ratio of a company’s equity available to common shareholders to the number of outstanding company shares. This ratio calculates the minimum value of a company’s equity and determines a firm’s book value, or Net Asset Value (NAV), on a per-share basis. In other words, it defines the accounting value (i.e. book value) of a share of a company’s publicly-traded stock.

To do this, they must subtract the total value of all debts and liabilities from the book values of all the assets shown on a company’s balance sheet. Market value per share and book value per share are both metrics used to gauge the value of a stock but are different assessments. Book value per share considers historical costs, whereas the market value per share is based on the company’s potential profitability. Book value per share is an important metric that investors use to evaluate the value of stocks. A stock is considered undervalued if the book value per share is more than the price at which it trades in the market. The book value of a company represents the net asset value (total assets – total liabilities) of a company.

If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. Book value per share (BVPS) tells investors the book value of a firm on a per-share basis.

Cart is empty

Cart is empty

دیدگاه خود را بنویسید